National insurance: a UK tax which is complex and vulnerable to political intervention

- Written by Gavin Midgley, Senior Teaching Fellow in Accounting, University of Southampton

The UK government has announced plans to raise the rate of national insurance by 1.25% to fund increased spending on health and social care. The move has divided opinion – and also brought attention to a tax that is one of the largest in terms of treasury revenue (second only to income tax), but probably one of the least understood.

Introduced in 1911, the expansion of national insurance to its current position as a pillar of the UK tax system was in 1948, as part of the creation of the welfare state. Then, as now, it was a tax on working income, with contributions made by both employees and employers (the self-employed also make contributions at a different rate to employees).

Previously, employees received stamps in exchange for their contributions, which would entitle them to benefits when they were needed. Originally there was one stamp for health and pension benefits, and another for unemployment benefits, but from 1948 one stamp covered everything.

Until 1975, the contribution was at a flat rate before it switched to being based on a percentage of earnings. The initial standard rate for employees was 6.5% but this has risen over time to the current rate of 12%, and will go up to 13.25% in April 2022. The other major change in 1975 was the introduction of a system which saw the contribution deducted through the Pay As You Earn (PAYE) scheme, as it is today.

Subsequent overhauls of the welfare system have resulted in the link between contributions and benefits becoming less clear. So while national insurance contributions still count towards a person’s state pension for example, other benefits (including Universal Credit and Housing Benefit) can still be claimed by those who do not contribute.

Also, unlike the relative simplicity of income tax rates, the intricacies of the current national insurance system may be less established and understood. In 2011, even the then shadow chancellor Alan Johnson appeared unsure of what the rate was during a TV interview.

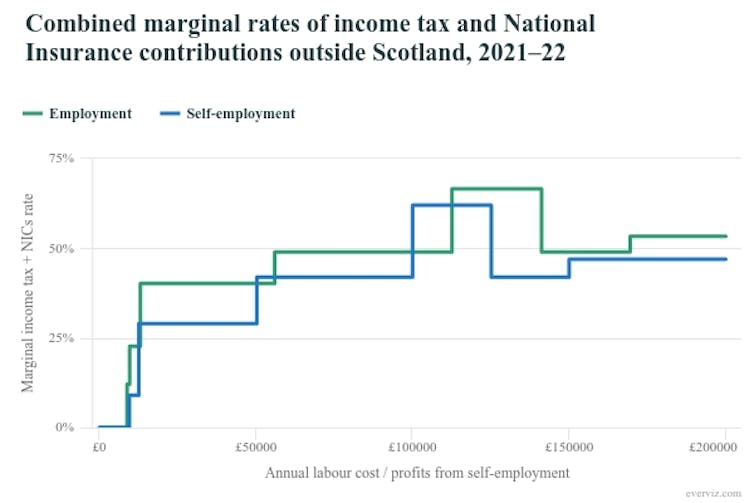

This lack of clarity could have a significant effect on the public’s perception of NI as a part of their tax payments. It may appear to be needlessly complicated and totally unaligned with the income tax system, as shown in this graph.

Combined marginal rates.Institute of Fiscal Studies,

Combined marginal rates.Institute of Fiscal Studies,In a progressive tax system one would expect the marginal rate of deductions paid to gradually increase as earnings increase. Yet in reality, the marginal increases and decreases occur at seemingly arbitrary thresholds.

The complexity of the system badly affects its transparency and people’s understanding of what they are paying and why. It even arguably allows politicians to take advantage of this situation with tax changes by stealth. This occurred in 2001 when a Labour government pledged to not raise income taxes but later increased the national insurance rate from 10% to 11% in their post-election budget (again to fund the NHS).

A further increase was announced by Labour in early 2010 to its current rate of 12%. Despite criticism of this proposal at the time from the Conservatives, they did not scrap the increase when they took power (with the Liberal Democrats) later that year.

Rates of change

The combination of the weak link between contributions and benefits as well as the complexity of the national insurance system means that some analysts believe it would be much simpler to combine income tax and national insurance into one direct tax.

The main argument is that it would simplify the tax system, making it easier for the public to understand, and more difficult to hide rate changes.

Read more: What national insurance is – and where it goes

But the key obstacle to making this change would be how employers’ contributions would be collected. Introducing an employers’ tax may be one option, but would no doubt be controversial.

Other hurdles include working out how a new system could be implemented across the UK, as there are currently differences between the four nations. Certainly no government in recent times has shown any appetite for making such substantial changes.

But if controversies over this (or any future) government’s handing of national insurance continue, it may give the opposition party a chance to find favour among voters for promising simplification and reform.

Gavin Midgley does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

Authors: Gavin Midgley, Senior Teaching Fellow in Accounting, University of Southampton